The tax calculator below calculates the increase from 2024 to 2025 assuming the new homestead exemption.

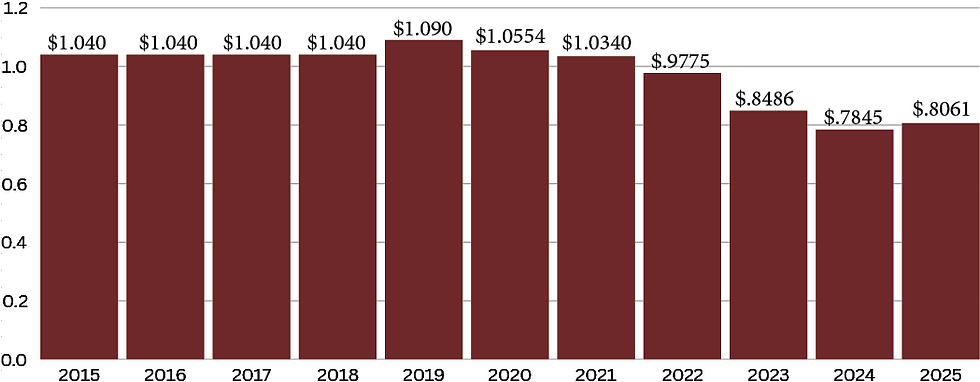

Hereford ISD Historical Values

Total Tax Rate

*projected tax rate if VATRE passes.

.png)

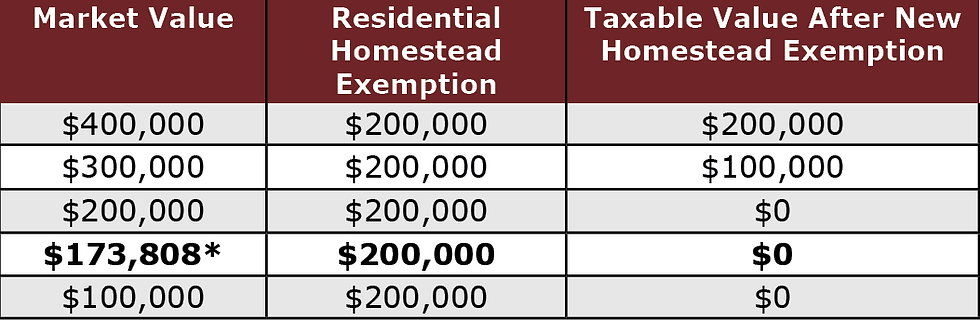

NO TAX INCREASE on homesteads for those having Age 65 Homestead Exemption Affidavit. Significant improvements to a homestead can increase the taxes. For questions on how to apply, contact your county appraisal district.

$200k Homestead Exemption - 65 AND OVER

*Average Taxable Value of a Residence in Hereford ISD $173,808, (Source Deaf Smith CAD, 2025, Cat A&E)

** Category A&E - 3,316 HS Residences

Current legislation proposes raising the homestead exemption to $200,000, homes at or below that value wouldn’t see a tax increase. If it doesn’t pass, the exemption stays at $110,000.

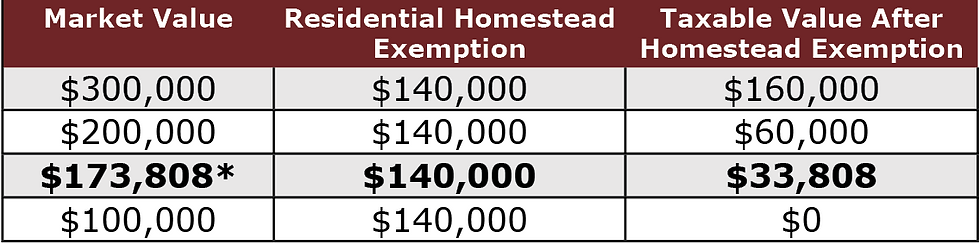

Tax Impact after $140,000 Homestead Exemption

*Average Taxable Value of a Residence in Hereford ISD $173,808, (Source Deaf Smith CAD, 2025, Cat A&E)

** Category A&E - 3,316 HS Residences

Current legislation proposes raising the homestead exemption to $140,000, homes at or below that value wouldn’t see a tax increase. If it doesn’t pass, the exemption stays at $100,000.